Sage Business Cloud Accounting

Sage Software

From the 2020 reviews of small business accounting systems.

Formerly known as Sage One, Sage Business Cloud Accounting is a good fit for sole proprietors, freelancers and micro-businesses. With complete cloud accessibility, Sage Business Cloud Accounting can be used with a desktop computer, laptop, tablet or smart phone, with mobile apps available for both iOS and Android devices. Sage Business Cloud Accounting offers two plans, though only the more expensive plan offers complete accounting capability.

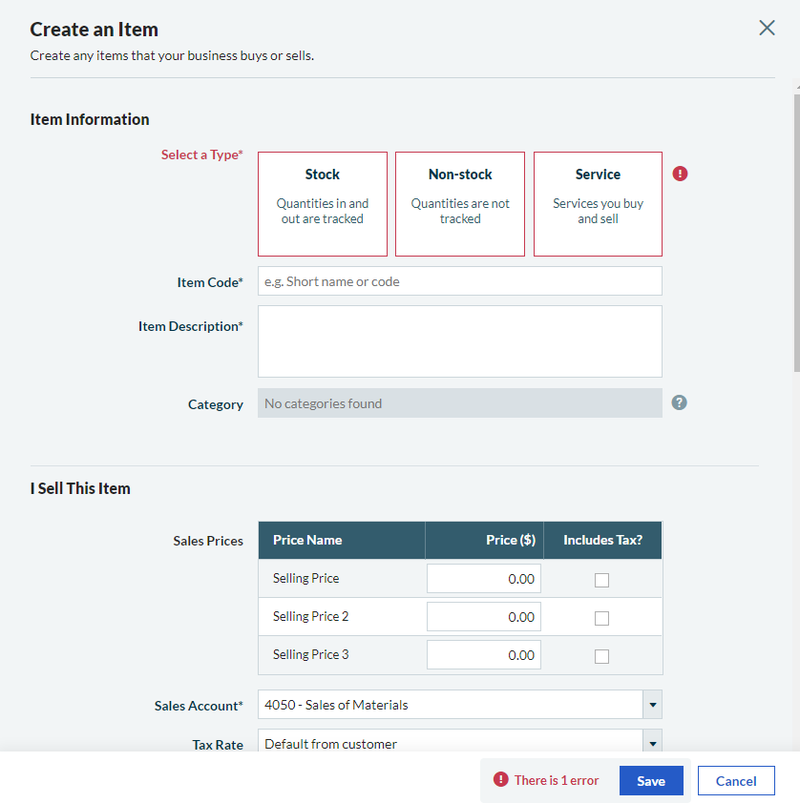

Sage Business Cloud Accounting includes an easily navigated entry screen that is intuitive and uncluttered. A variety of dashboards are available in the application that provide a summary view of Sales, Expenses, Cash Flow, and Cash Flow Forecast. While the Accounting Start version is suitable for freelancers who have limited accounting transactions, the Accounting version adds features such as real time reporting capability, as well as the ability to generate customer quotes and estimates. The Products and Services option in Sage Business Cloud Accounting allows users to easily manage products, non-stock items, as well as services, with an option to create up to three sales prices for each item entered in the application, and a default tax rate attached to the product or service.

Core Accounting Features: 4.25 Stars

New users will want to take advantage of the Getting Started option in Sage Business Cloud Accounting, which is designed to assist with product setup including customer setup, connecting banks or other financial institutions, setting up vendor details, and setting up the chart of accounts.

Sage Business Cloud Accounting includes a default chart of accounts, and users can customize the accounts to better suit their business. During the system setup process, users can complete a variety of processes, or come back at a later time to complete them. These include invoice customization, entering products and services, department setup, and cost codes. Products, services, vendors, and customers can all be set up on the fly, with users able to add a specific tax rate to each customer file for accurate tax calculation. Invoices are easily created in Sage Business Cloud Accounting, with the ability to add specific customers rates as well as any discounts if desired.

Invoices in Sage Business Cloud Accounting can be saved as a draft for editing at a later date. Completed invoices can be emailed directly to customers, with an option for customers to pay electronically using Stripe. Users have the option to review all invoices including current status from the Sales Summary page, which also includes a list of unpaid invoices, as well as current quotes and estimates that have been sent. Sage Business Cloud Accounting will also alert users when an invoice is past due, with an option to resend the invoice. Purchae orders are not currently available in Sage Business Cloud Accounting.

Vendor payments can also be paid electronically or via credit card, with the expense recorded when banking transactions are uploaded. Payroll functionality is not available in Sage Business Cloud Accounting, nor is time tracking. the application offers integration with a variety of point of sale applications including Lightspeed Retail, iVend Retail, Epos Now, and Aphix Cloud Platform. Sage Business Cloud Accounting accepts multiple currencies including the option to create an invoice in multiple currencies.

Relationship Management: 4.25 Stars

The Contacts feature in Sage Business Cloud Accounting manages both customer and vendors. Information available for customers includes both business and personal contact information, and both credit terms and credit limits can be assigned to customers. Users can also record banking details for electronic payment capability as well. Vendor detail available includes 1099 information such as Tax I.D. number or Social Security number, along with banking details for electronic payments. Sage Business Cloud Accounting also integrates with various third-party CRM applications such as SalesSeek, Capsule, eBridge Connections, Really Simple Systems, and OnePage CRM for businesses that need more in-depth CRM capability.

Cloud Capability: 5 Stars

Sage Business Cloud Accounting is accessible from a variety of devices including desktop computers, laptops, smart phones and tablets, with a mobile app available for both iOS and Android devices. The application supports both online and EFT payment capability and integrates with more than 100 apps in a variety of categories including online selling platforms,

Management Features: 4.5 Stars

Sage Business Cloud Accounting offers a variety of dashboards for system features such as Sales, Expenses, Cash Flow Statement and Cash Flow Forecast, with users able to easily customize the dashboards to display desired information. Information for all connected financial institutions can also be displayed, including current balance. Along with the dashboards, Sage Business Cloud Accounting offers good reporting capability, with an excellent selection of reports available including financial statements such as Profit and Loss, Balance Sheet, and Income Statement, as well as a Cash Flow Forecast, a Profit Analysis, a Sales Day Book, Sales Revenue, AR aging report, and an AP report. Reports offer little customization capability, but they can be exported as a CSV file for customizing if desired.

Tech Issues: 4.75 Stars

Sage Business Cloud Accounting offers good import and export capability, with users able to import data such as customer, vendor, and product lists directly into the application. Integration with a variety of third-party apps extend product functionality considerably, as does the available of the mobile apps. The application also offers an accountant’s version of the application.

Sage Business Cloud Accounting offers easy help accessibility, with users able to access help from within all user interface screens. Searching the knowledgebase can be challenging as Sage uses one knowledgebase for all of its applications, making the process a bit more tedious than it should be. There is also an online community that users can join to ask or answer questions, or search for solutions to common problems. Various product training options are also available from Sage, and product support is available during regular business hours via email, with users able to create a support case from the website. A 24/7 chat option is available as well.

Summary & Pricing

Sage Business Cloud Accounting is best suited for sole proprietors, consultants, and freelancers and is currently available in two versions; Accounting Start, which is an entry level system designed for those primarily looking for invoicing capability, which runs $10 per month, and the Accounting version, which is currently $25 per month and includes reporting, invoicing, and quote and estimate creation. Both versions are available as a free trial.

2020 Rating – 4.5 Stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs